CMS Efforts to Lower Drug Costs for Part D Stakeholders Aided by HealthTech

On August 28, the Centers for Medicare & Medicaid Services (CMS), the federal agency charged with administering the Medicare program, ruffled feathers when they unveiled the list of drugs eligible for negotiation with drug manufacturers. The list only includes ten drugs, but the move by CMS is considered a sea change in the effort to lower drug costs and improve access to treatments for chronic diseases such as diabetes and high blood pressure. The list offers a glimpse into CMS’ thinking and gives Part D stakeholders important information about which drugs should see savings, but uncertainties remain. For example, there is uncertainty as to how the new negotiation process will proceed and whether it will be effective enough to lower costs.

Confusion Abounds on Scope and Constitutionality of Negotiating Drug Prices for Part D

Roxanne Newland, R.Ph., Vice President of Pharmacy Operations at the managed care consultancy Rebellis Group, highlights one area of confusion surrounding CMS’ initiative: the magnitude of potential savings. Current negotiations between Pharmacy Benefit Managers (PBMs) and drug companies which shape formularies are typically kept under wraps as proprietary information. Thus, the potential savings emerging from CMS’s negotiations still need to be discovered.

Additionally, CMS’s selection criteria for the drugs on the list don’t account for Medicare’s net spending after factoring in rebates and other discounts. While CMS must work within existing constraints, this pricing doesn’t necessarily reflect the true behind-the-scenes negotiations with PBMs. This lack of transparency adds another layer of complexity.

Several parties filed lawsuits, challenging the constitutionality of the drug price negotiation process. Despite this legal backlash, senior administration officials have stated that CMS is not wavering. According to them, nothing in the constitution prevents Medicare from negotiating drug prices. They are steadfast in their commitment, boldly proclaiming, “We are moving forward and are not going to let the big drug companies stop us.”

Impacts to Manufacturers and Plans

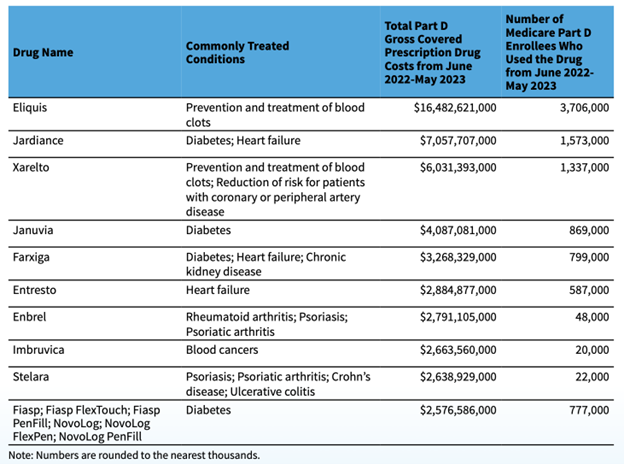

The selected group of drugs on the negotiation list collectively accounted for approximately $50 billion in total Part D gross covered prescription drug costs. According to an HHS press release, the cost represents roughly 20% of the overall Part D gross covered drug costs between June 1, 2022, and May 31, 2023. While the inner workings of CMS’s interpretation of their guidance may remain somewhat veiled, the fact that the list is now a reality, not just a theoretical concept, could prompt changes in the behavior of manufacturers and health plans.

The implications of this negotiation process stretch beyond the immediate future. Starting in 2025, plans will assume more financial responsibility for drugs in the catastrophic coverage phase. The later phase is triggered when enrollees exceed the $2,000 out-of-pocket cap established for 2024. The cost increase will likely fall on health plans, necessitating other strategies to control rising drug prices.

The plan’s liability in the newly created catastrophic phase is predicted to surge from 15% to 60% in the plan year of 2025. Lance Grady, Executive Vice President and Head of the Life Sciences Strategy & Growth Practice at Avalere, emphasizes that managed Medicare plans will need to explore various tools and strategies to adapt.

RazorMetrics Introduces Tech to Enable Physician Prescribers

HealthTech companies like RazorMetrics are poised to help plans manage the transition. RazorMetrics innovative, physician-first approach effectively creates guardrails around the client’s formulary to guide physicians’ prescribing behavior. The tech solution makes it easy for physicians to prescribe lower-cost medications with no extra logins, clicks, data lookups, or patient appointments. Drug switch recommendations are sent directly to the prescribing physician through the most ubiquitous channel in their daily clinical decision workflow. The switches are straightforward, easy to make, and save precious office time. Through our unique approach, we cover all providers, whether they are in or out-of-network. RazorMetrics is fully scalable and customizable to each client’s unique variables and formularies. Members save money at the pharmacy and, in turn, reduce pharmacy costs for health plans.

RazorMetrics’ platform complements existing pharmacy initiatives and works with PBMs and other drug cost savings solutions to optimize results. For more information, visit www.razormetrics.com.