Whenever Congress or state legislatures start talking about capping high drug costs or other legislative solutions, pharmaceutical companies argue that these laws are counterproductive. They argue that they must charge exorbitant prices for new drugs because it pays for the next class of cures. The logic is as follows:

- Higher drug prices pay out higher returns to investors, so

- Happy investors send more capital into new drug development, meaning

- Drug innovation increases! Healthier Americans!

- Reduced drug prices lower investor returns, so

- Unhappy investors put their capital somewhere else, meaning

- Innovation turns into nuclear winter.

But is this true? Apparently, no one really believed this claim, but there wasn’t hard evidence to argue against it, until now. A new research paper published in JAMA this month demolished the pharmaceutical industry’s assertion.

The research, led by Dr. Wouters at the London School of Economics and Political Science, looked at 60 drugs approved by the US Food and Drug Administration (FDA) between 2009 and 2018. The researchers used publicly available information about drug prices and pharmaceutical R&D spending. The researchers assumed that if the pharma claim about R&D spending was true, then they would see a correlation between R&D budgets and the ultimate price of the drug. This didn’t happen. Instead, they found no correlation.

Some drugs with very high market prices did not cost the pharma company a whole lot of capital to produce. So, why mark up the drug well past the cost to develop it? Ezekiel Emanuel, chair of the Department of Medical Ethics and Health Policy at the University of Pennsylvania, explained the reasoning, “It’s, ‘How far can I go? What will the market bear?’”

In the U.S., we pay approximately 2.5 times more than people in other countries. This matters, and it hurts; as much as one in four Americans cannot afford their medication. Unfortunately, the problem of affordability is getting worse. A 2022 study found that every year, the average price of newly released drugs is 20 percent higher than the previous year, which outpaces national inflation rates.

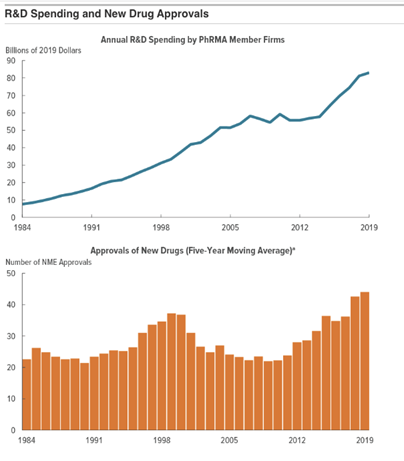

The USC-Brookings Schaeffer Initiative for Health Policy took a hard look at the relationship between pharmaceutical R&D and drug prices and came away with some interesting results. They found that R&D spending is not indicative of how many drugs make it to the market. Some years R&D spending is high, and new drug releases are low. Below is a graph of R&D spending from 1984 to 2019 and the corresponding number of new drugs released to the market. The spending steadily increased while the production of new drugs went up and down.

While this new research sheds light on the relationship between R&D and new drug production, the trend is likely to continue. In the Brookings research, they found that the price to bring a drug to market varied wildly. The pharma companies claimed it took about $2.8 billion to develop a new drug whereas independent researchers estimated the cost closer to $1.3 Billion. In either case, $1 billion to $2 billion is a substantial financial limb to be hanging out on for one drug.

It is no surprise that if the drug company can get away with charging upwards of $200,000 a year for a new drug, then they will do it. The drug company has a monopoly over the drug, and according to current law, they are allowed to set the price. This is how for-profit, publicly traded pharma companies work in the U.S. They are focused on recouping R&D costs and offering a nice payout to investors. Other countries use a different model.

In France and Germany, the national health departments negotiate directly with pharmaceutical companies, and the price is set based on the clinical benefits of a drug compared to other drugs that treat the same disease. The U.K. uses a “quality of life” metric, setting the price based on a drug’s ability to give a patient an extra year of good living. If the drug has little value in the quality of life compared to others, then the drug is not recommended at all.

When Medicare is allowed to start negotiating drug prices, we may see a slight change. In the meantime, there is a lot that health plans and self-funded employers can do to save on drug costs

Utilizing healthcare tech companies to improve formulary compliance is proven to help keep drug costs lower. A lot of work goes into creating a formulary, but prescribing physicians do not have access to this information or the time to dig into it. Companies like RazorMetrics are changing that by working with physicians directly during their normal workflow so they are able to prescribe the best, lowest-cost medication to their patients.