Over the past few years, prescription discount cards have become a go-to tool for tech-savvy early adopters looking to save on their prescriptions. But recently, you might have detected a noticeable uptick in the use of discount cards among friends and family. The surge in drug prices and resulting out-of-pocket costs for patients is a strong driver behind the trend.

How Do Discount Cards Work?

Discount cards are offered through online tools like GoodRx, SingleCare, and others (just google prescription discount card to find a full list). The “card” is tied to a specific medication and a pharmacy. Here’s how it works:

- Search for Your Medication: Type the name of the medication into the search bar, and a list of participating pharmacies show up with pricing.

- Choose a Pharmacy: Each pharmacy has their price—some cheaper than others (thanks pre-negotiated discounts!). Pick the pharmacy / price combo that works best.

- Download the Discount Code: The discount card code is presented at the pharmacy when picking up the prescription.

Not all medications have a discount, but the list is growing. For people who are uninsured or underinsured, getting the cash price down is helpful. For insured people, discount cards can get complicated.

Deductibles v. Discount Cards

Here’s where things get tricky. Typically, out-of-pocket prescription expenses are applied toward the deductible and out-of-pocket maximums. Once the deductible is hit, healthcare costs go way down. But when a discount card is used, the transaction is considered “cash pay,” which often doesn’t count toward the deductible. So, while the discounted price is lower than what would be owed using insurance, it presents a Sophie’s choice: Pay less now, or work towards meeting the deductible to save more later? The decision can significantly impact a member’s overall healthcare costs, especially if higher medical expenses occur later in the year.

What This Means for Members/Insurers

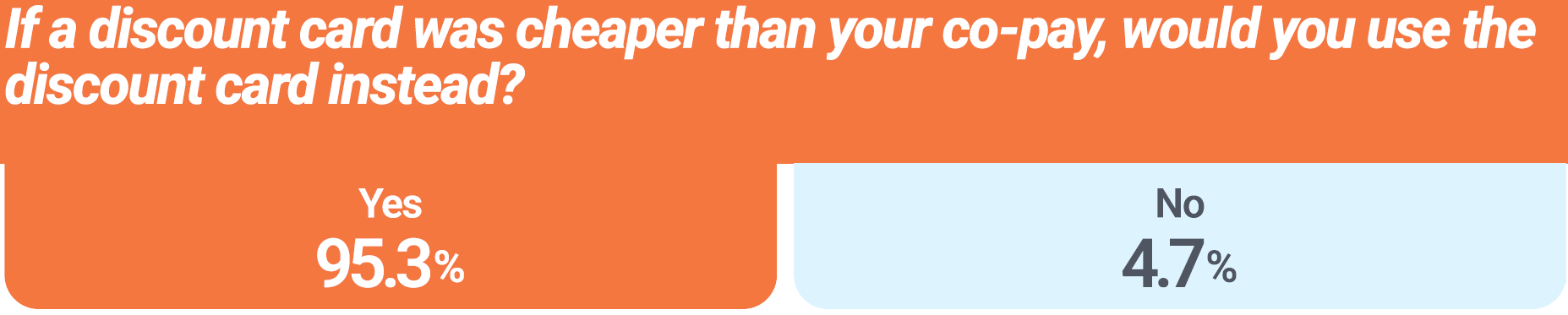

Discount cards can offer significant savings to members at the time of purchase, and they overwhelmingly choose to save money at the register. In the recent report, “State of Drug Access, 2024,” more than 95% of consumers reported that they would use a discount card if the price was lower than their insurance.

Despite strong consumer support, discount cards have clear downsides. First, it can complicate how member’s track and manage their out-of-pocket expenses to very disappointing results. If an expensive medical issue comes up, the money saved with the discount card could actually cost more in the long run.

From the perspective of insurance plans, discount cards can be a double-edged sword. On one side, they provide an excellent way for members to save on their prescriptions, which improves member satisfaction rates. Plus, the cost of the medication completely rolls off the plan’s budget. The discount card is 100% savings for the plan. On the other side, discount cards decrease the insurer’s visibility into members’ prescription habits and overall health, complicating the plan’s pharmacy program and formulary design for the following year.

Striking the Right Balance

While discount cards are very attractive to consumers because they offer immediate savings, the implications for the deductible are a crucial consideration for anyone using them. Understanding this balance is key to making informed decisions about when to use a discount card and when to rely on insurance. Several factors impact the price for drugs at the pharmacy register:

- Drug list price of the drug

- Health plan formulary design

- Cost-sharing requirements

- Negotiated discounts

How RazorMetrics Can Help

As a HealthTech company, we use AI to crunch vast amounts of data to match the best savings opportunity to each of our client’s members. Members appreciate the concierge service; they do not have to research each of the many discount card websites and find the best deal. We do that work for them. If we find a good option, then we inform members and their physicians about potential savings from discount cards and implications for their deductible.

We track the use of discount cards and provide visibility to our client by offering a full accounting of the prescription spending throughout the year. The tracking keeps our client in the loop on the cash pay side to ensure they have accurate information for future planning.

We developed a discount card program offering because the savings for health plans and employers were too great to ignore. By striking the right balance between immediate savings and long-term healthcare costs, RazorMetrics helps clients make the best use of discount cards—making it a true win-win.