We can help.

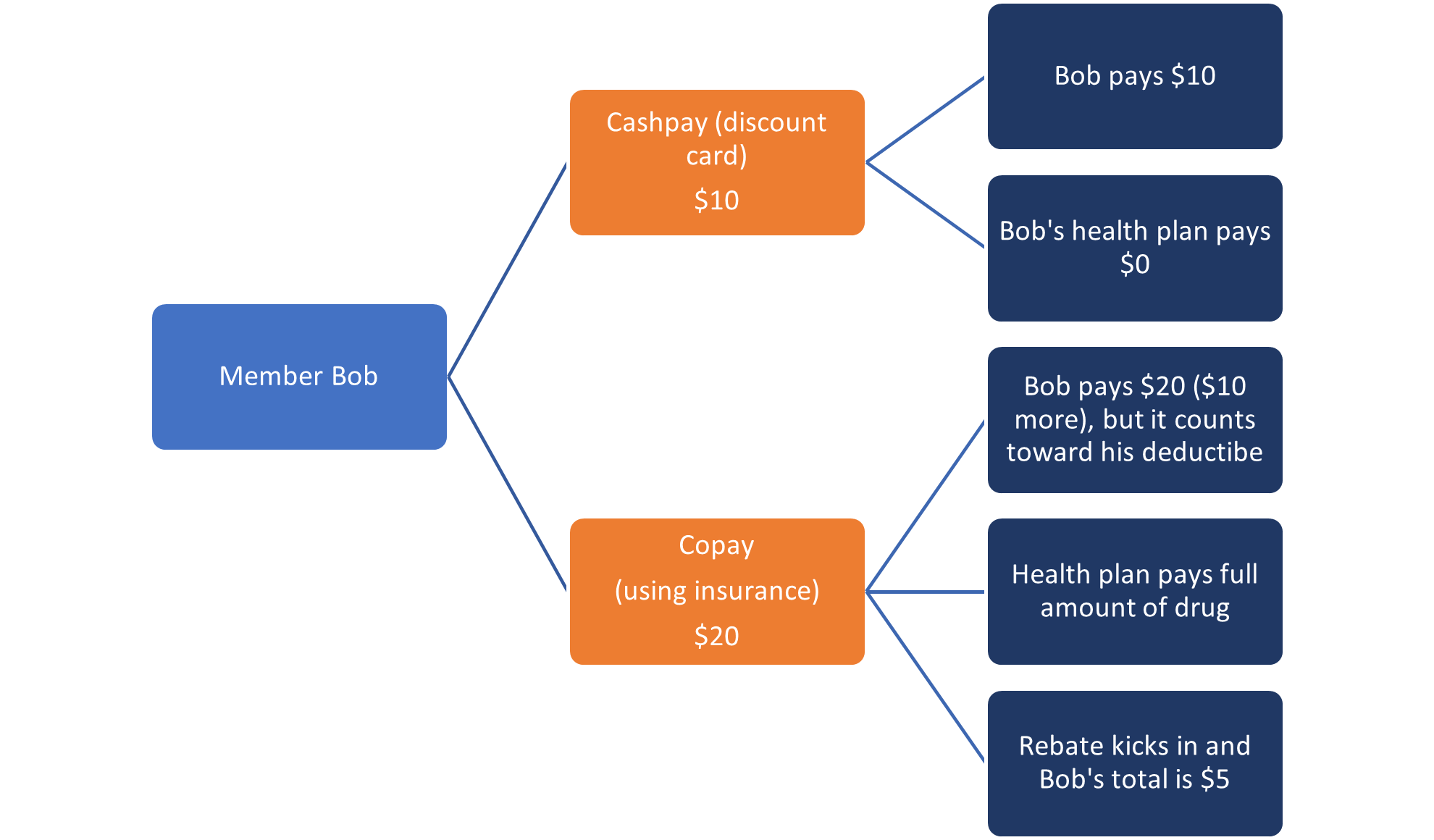

Cashpay or copay? For members, the choice can be a conundrum. In some cases, cashpay is less money out of their pocket. However, using the copay goes toward a deductible that will save money in the long-term. The calculus is enough to frustrate even the most reasonable person.

For payers and self-funded employers, suggesting cashpay to members/employees may sound counterintuitive. The negotiated price should be less expensive than the retail price, right? Not always. The formula behind the register price is complicated and multilayered, depending on the negotiated price of the medication, the pharmacy, discount availability, generic or brand-name, manufacturer coupon, and location. Members / employees have no visibility into the costs and most people assume the copay is the lowest cost.

Here is a diagram showing how the choice may impact cost.

Without help, no one is in a position to make an informed decision at the register. RazorMetrics takes the guess work out of it by sending members and their physician the best options before the pharmacy trip.

Using AI and our proprietary Intervention Codex, we analyze opportunities and, depending on client’s preferences, we point members / employees to the best option. For example, in high deductible plans, we can send members / employees a discount card code for their medication. For those with more expensive, chronic treatments paying toward a deductible may be more prudent and, in this case, we look for the best, lowest-cost alternative medication, pharmacy, delivery, or administration route (i.e., inhaler, injection, absorption. etc.).

Further, we capture the upstream savings to the insurance provider. Every time a patient switches to a cash-pay method, the entire cost of the prescription rolls off the carrier’s budget.

Health insurance coverage is critical for all Americans, and RazorMetrics adds value by taking the work out of finding the lowest-cost option for patients, their physicians, and pharmacists. Because standing in front of the pharmacy register is not the time to make an informed decision. Members / employees need to be armed with information beforehand. Contact RazorMetrics today to optimize your pharmacy benefit offering.